Bitcoin topped $10,000 today. So far, the 2020 Bitcoin market has developed much as expected.

Xbit closed 50% of its position yesterday at around noon, Japan time. After closing the position, bitcoin continued to rise. Of course, it was difficult to close the position due to “FOMO – Fear of missing out”. However, giving into this fear by jumping back too quickly into the market is almost always a mistake.

The chart below shows the timing of buys and sells of Xbit so far this year. The green arrows indicate long positions, the red arrows indicate profit taking, and the pale yellow arrows indicate profitable trades. As you can see, after closing a position, the price increased slightly every single time. Every time, that FOMO feeling was triggered, but as you can see on the graph, jumping back in too soon would have exposed Xbit to significant losses.

Not all traders have made money in 2020. Why?

First, trading is psychologically difficult. I sometimes think, the essence of trading is misunderstood. Many people seem to think trading is about leveraging technical indicators in some mysterious way to somehow predict the future. Of course, price anticipation is one important aspect, but the essence of trading – the skill a trader must perfect – is controlling one’s emotions. If you want to increase your number of successful trades, you need to start by overcoming your emotional instincts.

I also think many people trade when they shouldn’t. Let me give you a simple analogy. I always compare trading in the markets to street fighting. Smart street fighters only fight people they know they can beat. Trading is the same. If you only make a move when the probability of winning is very high, then the likelihood of getting knocked out is greatly reduced.

After being involved in this business in one form or another for nearly 30 years, I don’t mind telling you 80% of the time, its simply not clear what the market is going to do next. After so many years of studying technical analysis I’ve learned one important lesson – don’t waste your time trying to decipher the 80% of price action you don’t understand. Focus on the 20% that you do understand. Trade when you recognize exactly what you’re dealing with, otherwise walk away – just like a street fight.

Is Bitcoin on its way to setting record highs?

As I write this, bitcoin is trading $150 above where I closed out our position. Of course FOMO is gnawing away at me. However, you have to look at the situation objectively. Remember, it’s smarter to take profit and protect gains than it is to try to squeeze out an extra $150.

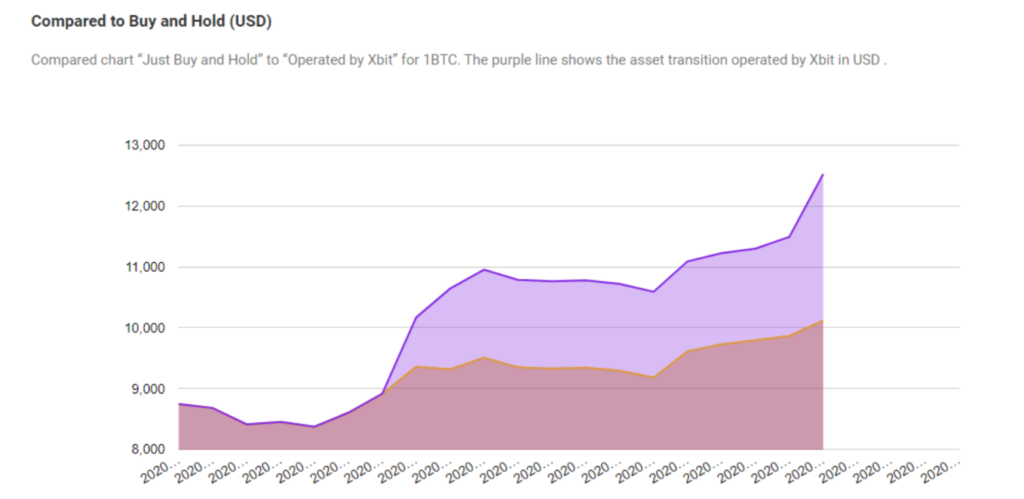

So far, our strict trading discipline has been rewarded. Xbit launched, January 26th. In only two weeks, Xbit has increased 23% (after commissions and performance fees). This means every 1 BTC deposited at the launch of Xbit is now worth 1.23 BTC. To be clear, this means investor’s total return is 1.23 BTC multiplied by the current price of BTC.

I continue to be confident that this will be an excellent year for investors to build bitcoin positions. I also think there is a good chance we might see bitcoin prices break through to highs not seen since 2017.

(This image shows the change in assets in UD dollars since January 26, 2020 – 1 BTC – buy and hold in red vs. traded with Xbit in purple.)